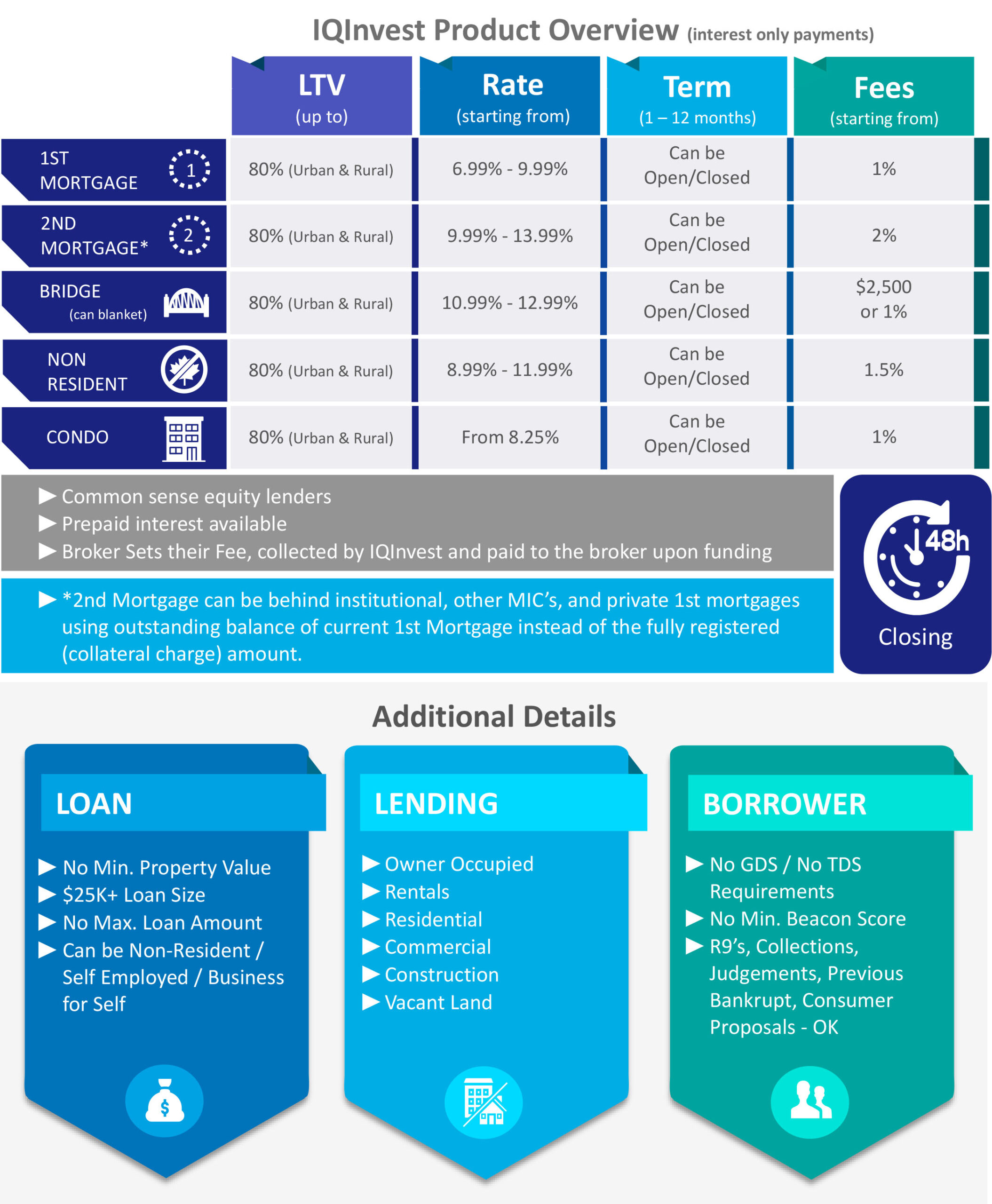

Maximum Loan to Value Summaries

Loan Size – $25,000 and up

Additional Details

- These are Guidelines Only – Rate and fees can be adjusted to make the deal work!

- Broker’s Fee will be collected by IQInvest and paid to the broker upon funding

- Closed term or Open term on a 3-month interest penalty

- 2nd Mortgages – 1st Mortgages can be private

- Rates can be bought down and added to lenders fee

Documents for Submission:

To find out more please download:

Frequently Asked Questions

Q. Which part of Ontario do you lend to?

A. We lend throughout Ontario including urban, suburban and rural locations.

Q. Who orders the appraisal?

A. Broker to order from Appraisal management company. You can find a list of our Approved Appraisers here.

Q. Where should I email the conditions and supporting documentation?

A. Once your deal is approved, you can email all conditions and supporting documentation directly to docs@iqinvest.ca.

Q. My client’s mortgage is coming to maturity now what?

A. We do ot take your clients. Our policy is to send clients back to their originating broker. A reminder will be sent (or call) to you and your clients when there are approximately 60-90 days left before your client’s mortgage matures.

Q. Why do you require 6 months of bank statements?

A. We require 6 months of bank statements for cash flow verification purposes.

Q. My application was approved for 75% LTV but I requested 80% LTV?

A. We assess each application based on its merits. Approved loan to value depends on many factors including the property, area and applicant’s credit risks.

Q. Do you accept applications with bankruptcies? Double bankruptcies? What type of re-established credit do you require?

A. Yes, we do accept clients who have been bankrupt but are discharged. We prefer not to work with applicants that show double bankruptcies as the risk associated with lending to this type of client is too high. In terms of re-established credit, the underwriting department expects a minimum of 2 years re-established credit including a minimum of 1-2 trade lines.

Q. What types of new immigrant applications will you accept? What documentation am I required to provide for this type of client?

A. We will accept new immigrant applications so long as the client has obtained Landed Immigrant Status within the last 3 years or has the supporting documentation to prove that the borrower’s application for Permanent residence in Canada has been approved. The documentation must include the following a) a letter from the government confirming Landed Immigrant Status, or b) a Permanent Residency Card.