Investment Porfolio

Current as of December 15, 2023

Loan-To-Value Under 75%

Loan Amount

Interest Rates

Mortgage Terms

Nature of Underlying Property

Mortgage Rank

Property Type

Investment Objectives

IQInvest Mortgage Investment Corporation invests primarily in first, second and third mortgages secured by residential and commercial properties located in Canada. Mortgage terms are typically 3 to 12 months which minimizes real estate price fluctuation risk, interest risk and duration risk.

To maintain a stable yield on our mortgage portfolio, we manage risk through maintenance of a diversified mortgage portfolio, conservative underwriting and diligent and aggressive mortgage servicing. Our objective are: (i) to preserve our shareholders’ equity, and (ii) to provide our shareholders with stable and secure dividends from our investments in mortgage loans within the criteria mandated for a MIC. Working within conservative risk parameters, we endeavour to maximize yields dividends through the sourcing and efficient management of our mortgage investments.

The Corporation’s mortgages are all secured by properties.

Our fund is distributed through Exempt Market Dealers and Securities Dealers. Our MIC is available on a private placement basis to qualified investors who purchase through registered dealers.

Why Invest?

- Secured by real estate in Canada

- Consistent yield of 5% per annum for Class A fund and 8.5% per annum for Class B fund since inception

- Low volatility that gives you peace of mind

- Low development risk – portfolio consists of existing properties

- Annual audit required by CRA under Income Tax Act Section 130.1

- Minimum investment is only $25,000

This Investment Is For Investors Who:

To find out more please download:

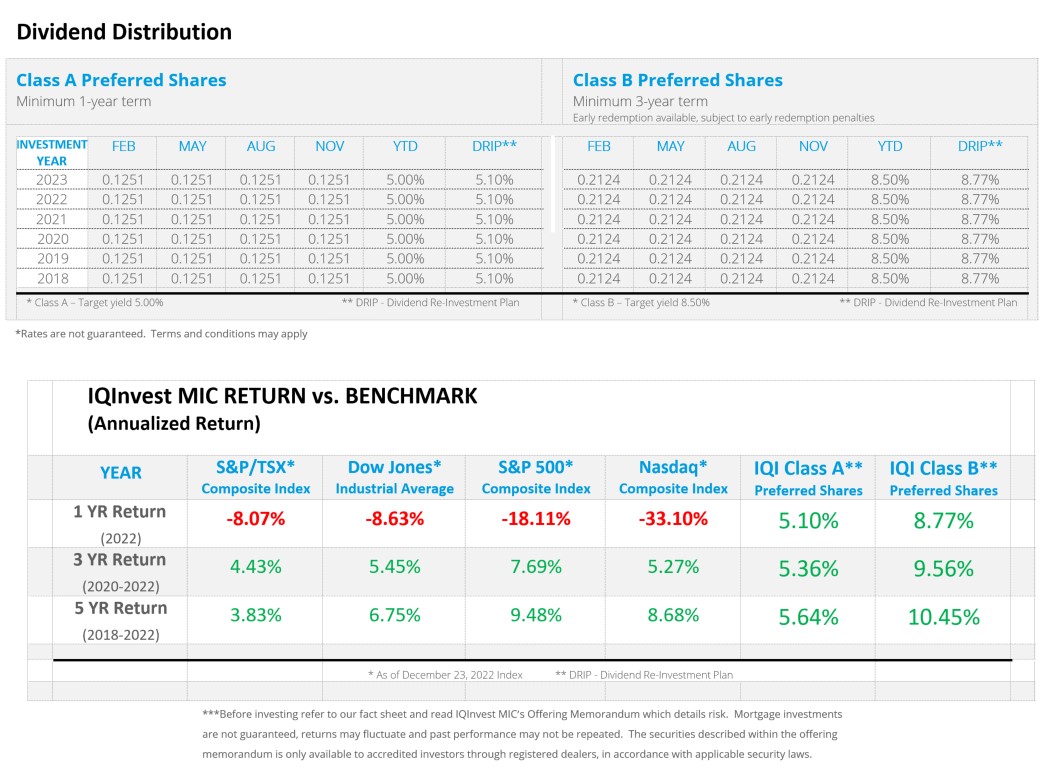

Dividend Distribution

The Corporation’s policy is to pay a substantial part of its earnings to its shareholders. The Corporation currently expects to declare dividends quarterly, on the last day of each quarter. Once declared, dividends are payable by the Corporation, and will be paid on a quarterly basis on or about each of November 30, February 28, May 31 and August 31 and paid on the 15th day of the month following such quarter end. Additional dividends may be declared by the Corporation from time to time.

Growth of $100k Invested with IQI MIC Class A Shares since Oct 2017 to Dec 2023 with 100% Dividend Reinvestment:

$135,870.26

Growth of $100k Invested with IQI MIC Class B Shares since Oct 2017 to Dec 2023 with 100% Dividend Reinvestment:

$167,947.71

Since 2018, the following dividends have been paid:

*IQI MIC’s past performance is not an indicator of future results.